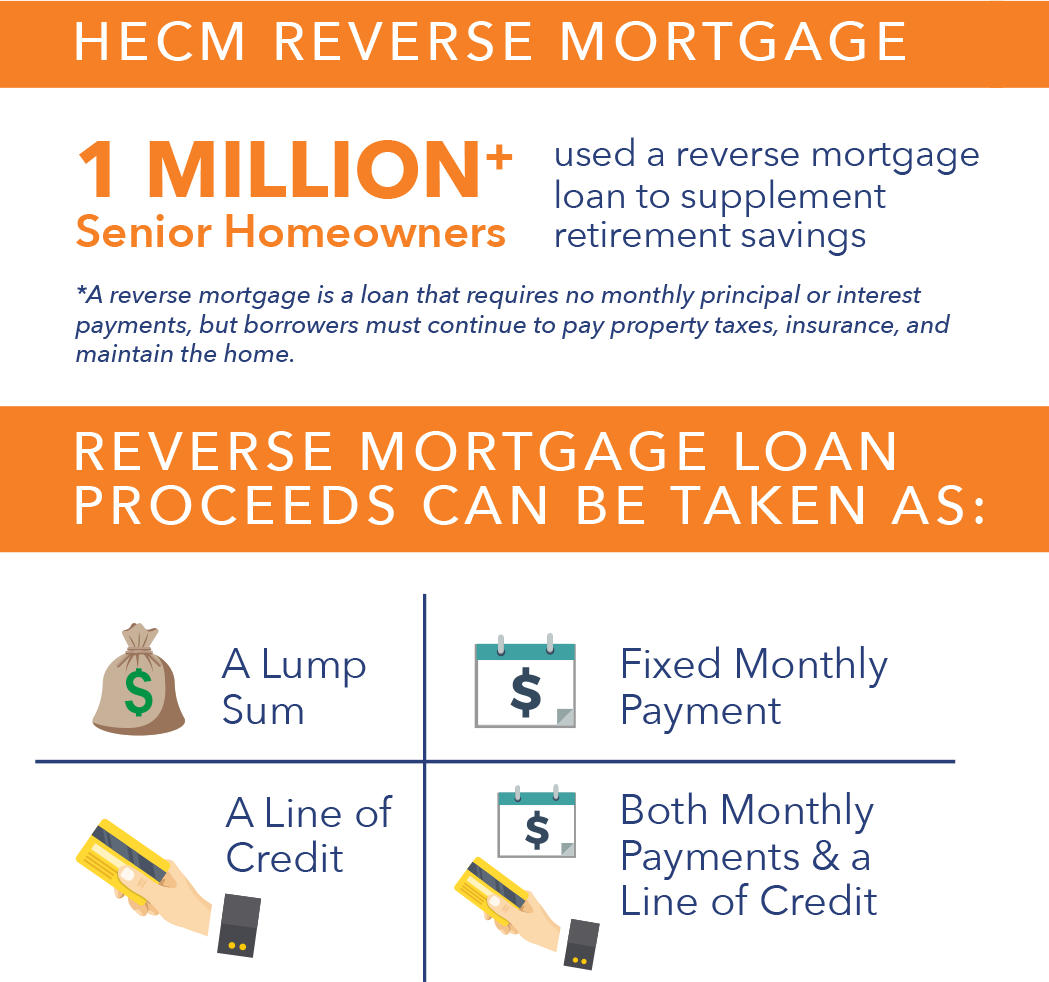

For seniors, a reverse mortgage is a valuable tool that can benefit financially planning retirement. This type of home loan is for homeowners 62 years of age or older and requires no monthly payments to your mortgage. Borrowers are only responsible for paying their property taxes and homeowner’s insurance. Instead, they will be sent monthly payments for the home until the home is either sold or moved out of.

The most common misconception with a reverse mortgage is that a lender becomes the owner of your home. This is untrue, and you will remain the owner of your home, as long as you comply with the loan terms and continue to pay your insurance and your taxes. You will not be required to pay monthly mortgage payments, are protected from market declines, and your Social Security and Medicare benefits remain unaffected.